据烃加工网1月13日报道,据知情人士称,埃克森美孚(exxonmobil Corp)未来几天将大幅提高其位于得克萨斯州博蒙特(Beaumont)炼油厂的汽油和柴油产量,从而完成9年前首次考虑的12亿美元扩建计划。

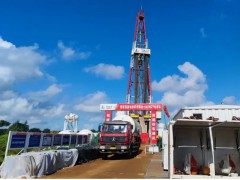

据消息人士称,预计将于1月31日在36.9万桶/日的炼油厂首次启动25万桶/日原油蒸馏装置(CDU),使博蒙特炼油厂成为美国第二大炼油厂。

这是近十年来美国首次对石油加工进行大规模扩建,新增了相当于中型炼油厂产能的炼油厂,并在美国政府敦促炼油厂生产更多燃料或面临处罚之际如期上线。

美国的柴油和汽油库存接近五年来的最低水平,美国墨西哥湾沿岸地区生产汽车燃料的利润率接近历史最高水平。

根据Refinitiv的数据显示,炼油商利用该行业的价差(一种将原油成本与汽油和柴油销售价格进行比较的利润衡量指标)每桶可赚取约35.40美元。

精炼投资银行家Aegis Energy Advisors Corp.总裁加菲尔德•米勒(Garfield Miller)称,目前利润率非常可观。这些利润率告诉市场,就美国墨西哥湾海岸而言,相对于供应而言,需求充足。

页岩油制柴油

埃克森美孚没有立即对新的加工装置——博蒙特轻质常压蒸馏扩建(BLADE)项目的启动发表评论。

早在2014年就被考虑,并于2019年正式批准的BLADE,计划加工埃克森美孚从西得克萨斯州和新墨西哥州二叠纪页岩油田开采的原油。

埃克森美孚尚未透露会有多少新的汽油和柴油流入。但埃克森美孚高级副总裁杰克·威廉姆斯(Jack Williams)去年3月告诉华尔街分析师,此次扩建将日产12万桶的精炼产品,包括汽油、柴油和航空燃料,并为该公司在其他位于墨西哥湾沿岸的炼油厂供应原料。

启用新设备不会立即生产大量新的汽油和柴油。据知情人士表示,埃克森计划缓慢推出新的CDU,以应对潜在的初创公司问题。

新的CDU将是博蒙特的第三个CDU,其将使该炼油厂的产能增加68%。CDU负责将原油转化为炼油厂所有其他装置的原料。

BLADE由模块化部分组成,历时四年,其间包括2019年疫情影响和2020年汽车燃料需求大幅下降,导致这家美国第一大石油公司的年度亏损创下历史新高。

据知情人士表示,博蒙特炼油厂的运营商本周正在清除新的CDU中的空气,以准备推出其首批原油。

据分析师表示,新的CDU将弥补2022年年底Lyondell basell Industries关闭日产26.3776万桶的休斯敦炼油厂时损失的炼油产能。

Aegis Energy Advisors的Miller表示,在疫情暴发之前,美国每年通过扩建、解决瓶颈和调整结构,在现有产能基础上增加相当于一个世界规模炼油厂的产能。

据美国能源信息署(U.S.Energy Information Administration)去年6月发布的一份报告显示,自疫情暴发以来,美国六家原油精炼厂已关闭,使美国的日产能从1898万桶降至1790万桶。

后疫情时代的里程碑

埃克森美孚在博蒙特的扩建标志着一个时代的回归,即通过调整加工工艺和向现有工厂增加新设备来稳定提高炼油产能。

能源银行Tudor, Pickering, Holt & Co.负责炼油厂、化学品和可再生燃料研究的董事总经理Matthew Blair表示,有几家大型石油公司在美国以外的地方扩建炼油厂。

布莱尔援引科威特、墨西哥、尼日利亚和亚洲的项目情况称,总体而言,今年将有相当多的新炼油厂处于待审状态。

他使用了加工利润的行业术语补充道,这将有助于重新平衡全球市场,减少产品价差。

郝芬 译自 烃加工网

原文如下:

Exxon prepares to start up $1.2 B Texas oil refinery expansion

Exxon Mobil Corp in coming days will sharply boost gasoline and diesel production at its Beaumont, Texas, refinery, people familiar with the matter said, completing a $1.2 B expansion first considered nine years ago.

Initial startup of a 250,000 bpd crude distillation unit (CDU) at the 369,000 bpd refinery is expected by Jan. 31, the sources said, making the Beaumont refinery the second largest in the United States.

It is the first major expansion to U.S. oil processing in nearly a decade, adding the equivalent of a mid-sized refinery, and coming online as scheduled at a time when U.S. President Joe Biden has been urging refiners to produce more fuels, or face penalties.

U.S. stockpiles of diesel and gasoline are near five-year lows, and profit margins for producing motor fuels in the U.S. Gulf Coast region are near record levels.

Refiners are earning about $35.40 per barrel using the industry's crack spread, a profit measure which compares the cost of crude oil to sale prices for gasoline and diesel, according to Refinitiv.

"Right now, margins are sensational," said Garfield Miller, president of refining investment banker Aegis Energy Advisers Corp. "These margins tell you that as far as the U.S. Gulf Coast is concerned, there is plenty of demand relative to supply."

SHALE OIL TO DIESEL

Exxon had no immediate comment on the start up of the new processing unit, called the Beaumont Light Atmospheric Distillation Expansion (BLADE) project.

BLADE, considered as early as 2014 and formally approved in 2019, was planned to process Exxon's crude oil pumped from the Permian shale field in West Texas and New Mexico.

Exxon has not said how much new gasoline and diesel will flow. But Jack Williams, an Exxon senior vice president, told Wall Street analysts last March the expansion will create 120,000 bpd of refined products, which includes gasoline, diesel and jet fuel, and supply feedstocks for its other Gulf Coast refineries.

Turning on the new equipment will not immediately generate big new volumes of gasoline and diesel. Exxon plans to bring the new CDU up slowly to deal with potential startup problems, the people said.

The new CDU, which will be the third at Beaumont, will increase the refinery's capacity by 68%. CDUs do the initial work of turning crude into feedstocks for all other units at the refinery.

BLADE was constructed from modular sections over four years, a period that included the COVID-19 pandemic and 2020's massive decline in motor fuel demand that led to a record annual loss for the No. 1 U.S. oil firm.

Operators at the Beaumont refinery this week were purging the new CDU of air in preparation to introduce its first crude, the people familiar with the matter said.

The new CDU will make up for the refining capacity to be lost at the end of this year when Lyondell basell Industries shutters its 263,776 bpd Houston refinery, said analysts.

“Up until COVID, the U.S. added the equivalent of a world scale refining facility to existing capacity every year through expansions, de-bottlenecking, and tweaks,” Aegis Energy Advisers' Miller said.

Since the COVID-19 pandemic began, six U.S. crude oil refineries have closed dropping U.S. capacity from 18.98 million bpd to 17.9 million bpd, according to a U.S. Energy Information Administration report issued in June.

POST-PANDEMIC MILESTONE

Exxon's Beaumont expansion marks a return to an era of steady refining capacity gains through processing tweaks and adding new equipment to existing plants.

There are several major oil companies adding refineries outside the United States, said Matthew Blair, managing director of refiners, chemicals and renewable fuels research at energy banking firm Tudor, Pickering, Holt & Co.

“Overall, there are quite a number of new refineries on the docket this year,” Blair said, citing projects in Kuwait, Mexico, Nigeria and Asia.

“This will help rebalance global markets and bring down product cracks,” he added, using the industry term for processing margins.

免责声明:本网转载自其它媒体的文章及图片,目的在于弘扬石化精神,传递更多石化信息,宣传国家石化产业政策,展示国家石化产业形象,参与国际石化产业舆论竞争,提高国际石化产业话语权,并不代表本网赞同其观点和对其真实性负责,在此我们谨向原作者和原媒体致以崇高敬意。如果您认为本站文章及图片侵犯了您的版权,请与我们联系,我们将第一时间删除。